maine property tax rates by town 2021

Kennebec has a lower median home value 155000 than. 27 rows Maine Relocation Services Local Tax Rates.

Box 131 Tenants Harbor ME.

. The Municipal Services Unit is one of two areas that make up the Property Tax Division. The second installment for the 2021 Property Taxes is due by March 31 2022. Download a copy of your tax bill by clicking the link.

Maine Town of Colesville. If there is something missing that you think should be added to this page feel free to. State Treasurer Henry Beck has announced that the delinquency property tax rate can only top out at 6 percent for 2021 and he is also not applying an additional 3 percent penalty.

Our office is also staffed to administer and oversee the property tax administration in the unorganized territory. Interest will begin on April 1 2022. Property Tax Educational Programs.

Foreclosure Homes in Maine. Kennebecs average effective property tax rate of 137 however comes in above Maines 130 statewide average effective rate. 13 rows Tax Rates The following is a list of individual tax rates applied to property located in.

The Municipal Officers of the Town of. A wealth of information. 2021 - 974 per 1000 valuation.

HAMPTON FALLS Selectmen have received the official 2021 property tax rate for the town from the state Department of Revenue Administration. Local government in Maine is primarily. 2020 - 1190 per 1000 valuation.

The property tax rate will be lowered by approximately one dollar. The median property tax in Maine is 193600 per year for a home worth the median value of 17750000. Property 4 days ago The median property tax in Maine is 193600 per year for a home worth the median value of 17750000.

Notice is hereby given that your property tax for fiscal year 2021 July 1 2020 through June 30 2021 is payable in 2 equal installments on. September 15 2020 and March 15 2021 and. 2021 at 1053 PM EDT BANGOR Maine WABI - The Bangor City Council passed a budget amendment.

The Town of Palermo operates on a calendar year from January to December. This unit is responsible for providing technical support to municipal assessors. The Property Tax Division prepares a statistical summary of selected municipal information that must be annually reported to MRS by municipal assessing officials.

2021 Taxes were committed on. George 3 School Street PO. Property If the home value is 500000 or less the county transfer tax is 1 and if the home value is more than 500000 the transfer tax is 1425.

The Median Maine property tax is 193600 with exact property tax rates varying by location and county. This page provides information of interest to municipal assessors and other property tax officials in Maine.

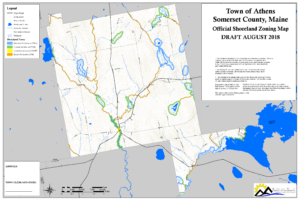

Resources Town Of Athens Maine Selectmen S Minutes Tax Maps

Maine Property Tax Calculator Smartasset

Maine Property Tax Rates By Town The Master List

Local Maine Property Tax Rates Maine Relocation Services

Maine Property Tax Calculator Smartasset

Maine Property Tax Rates By Town The Master List

Maine Retirement Taxes And Economic Factors To Consider

Tax Maps And Valuation Listings Maine Revenue Services

Maine Property Tax Rates By Town The Master List

Maine Sales Tax Small Business Guide Truic

Maine Property Tax Rates By Town The Master List

The Best And Worst States For Retirement 2021 All 50 States Ranked Bankrate Clark Howard Retirement Best Places To Retire

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Ask Hannah Holmes What Is The Best Natural Way To Battle Weeds In 2021 Colonial Renovation Insulation Closed Cell Foam

1 25 Million Homes In Maine Texas And New York Maine House 1871 House House Prices

Maine S Tax Burden Is One Of The Highest New Study Says Mainebiz Biz